Invoices and Payments

Invoices

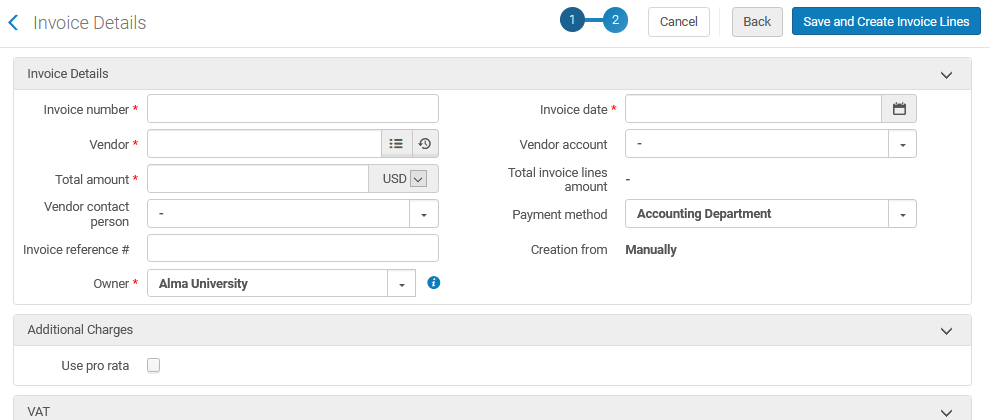

How are invoices created in Alma?

- Electronic data interchange (EDI) with a vendor

- Creating an invoice from the PO

- Creating an invoice manually or

- Loading invoices from an Excel file.

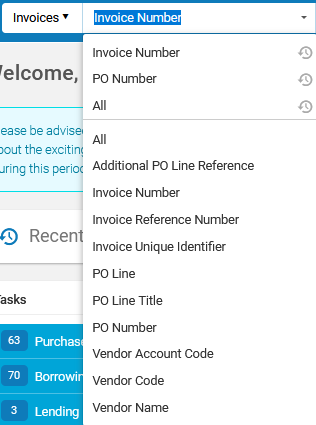

How are invoices accessed, searched?

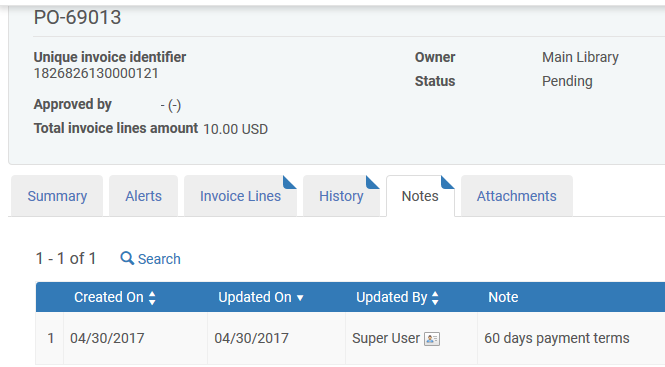

The history tab on the invoice record tracks all changes made to an invoice.

When paying an invoice is it possible to manually enter a specific exchange rate?

- Invoice currency is USD

- Foreign currency is KZT

- Explicit ratio is 2.5

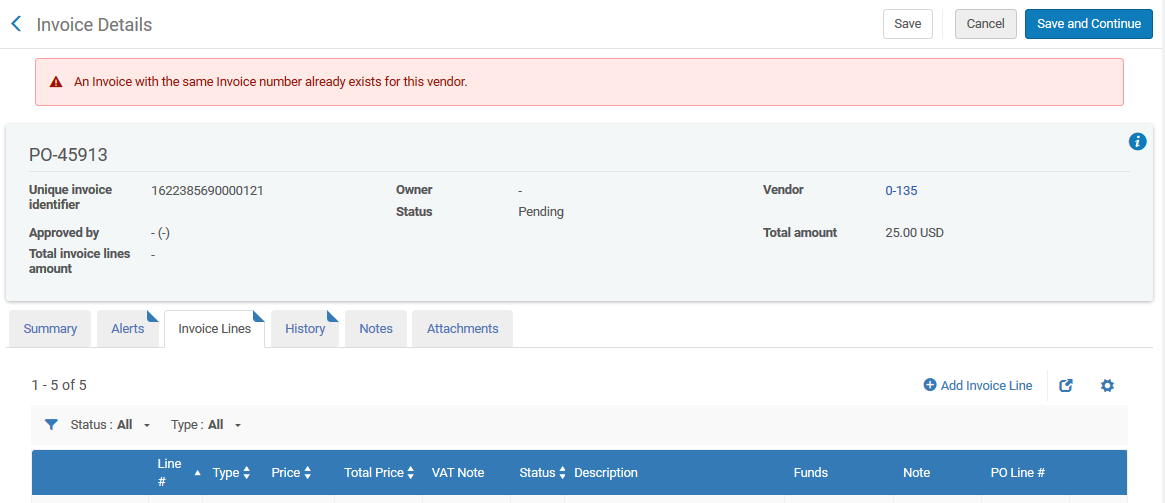

How does Alma handle duplicate invoices?

Can an invoice be deleted?

Staff users with the role 'invoice operator extended' can delete an invoice.

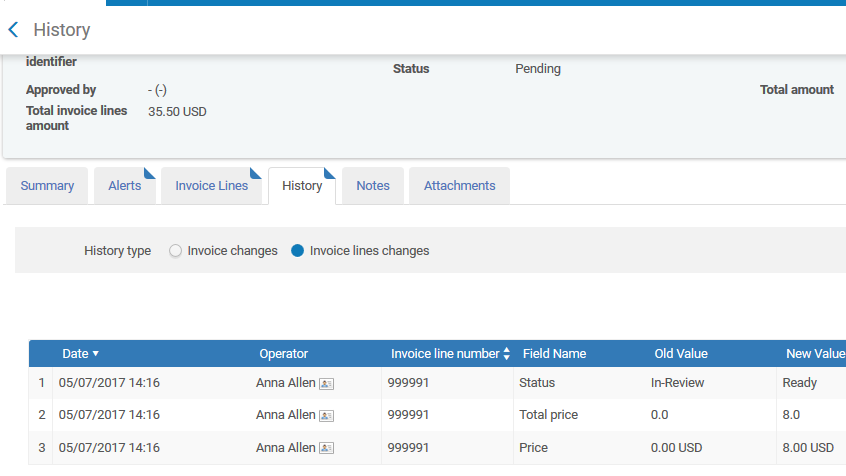

Does Alma create an audit trail of changes made to an invoice?

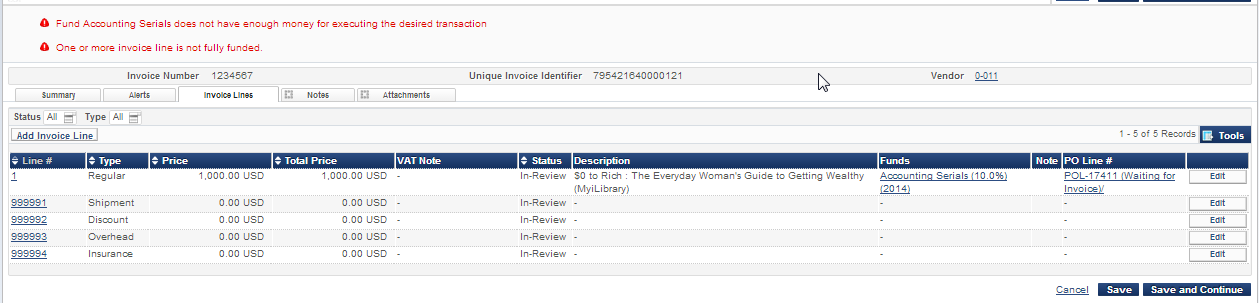

How does Alma handle invoices linked to over-expended budgets?

Can an invoice be partially paid?

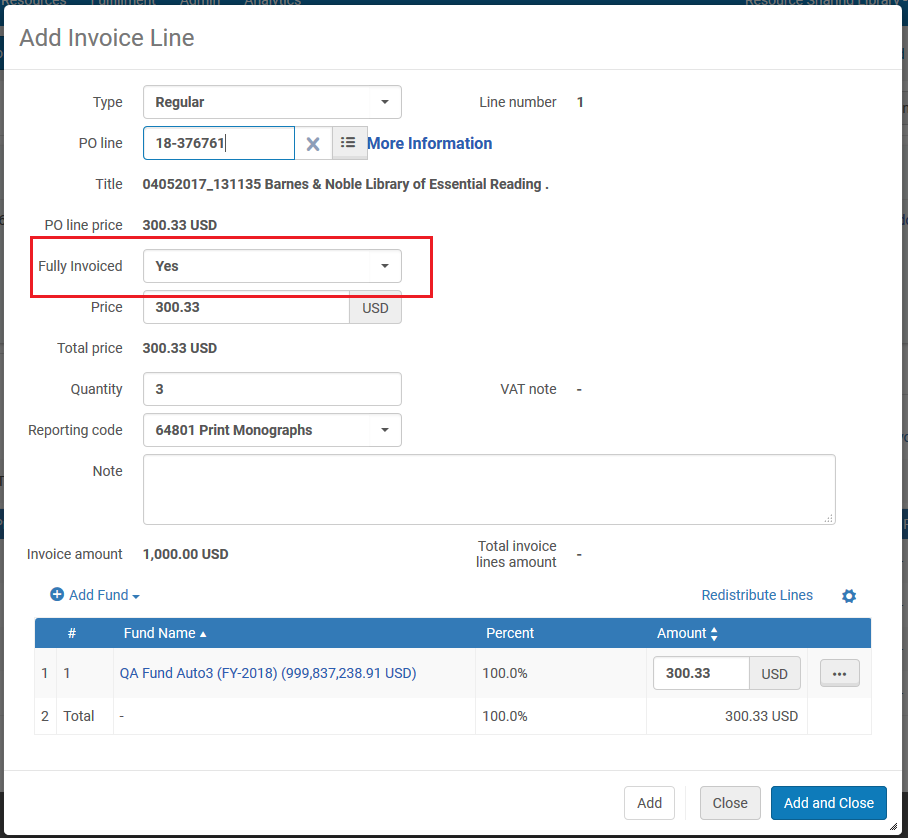

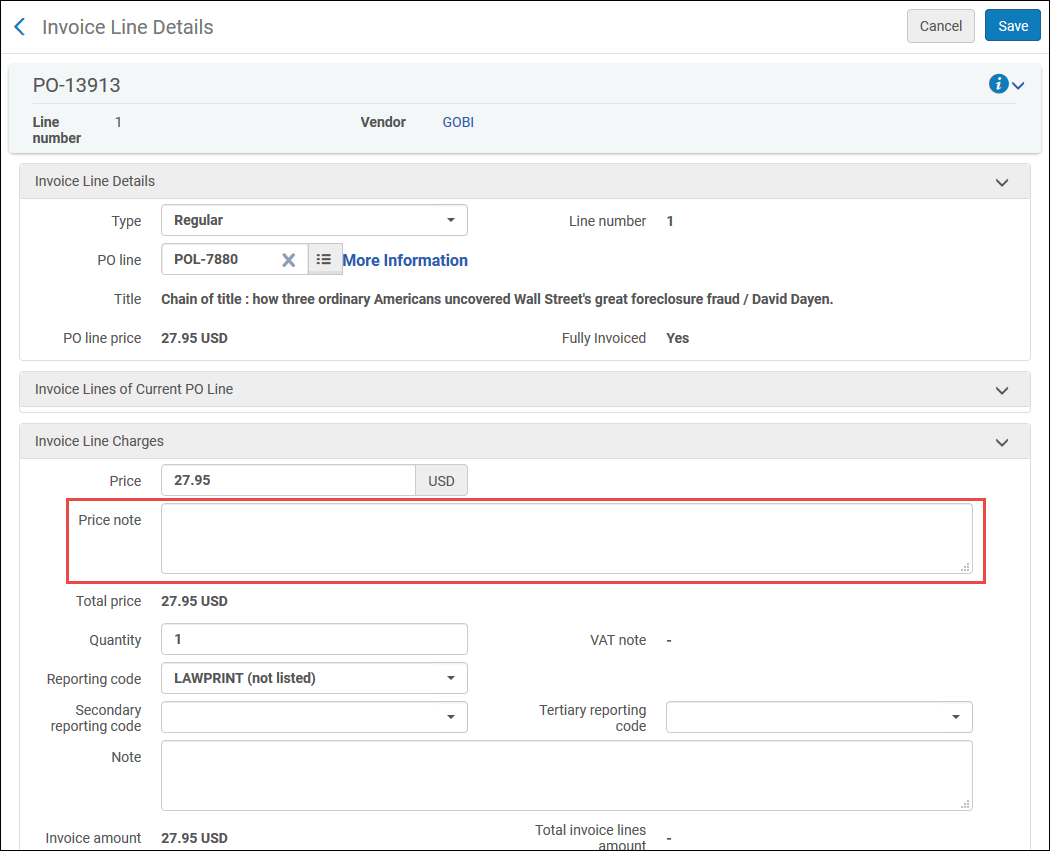

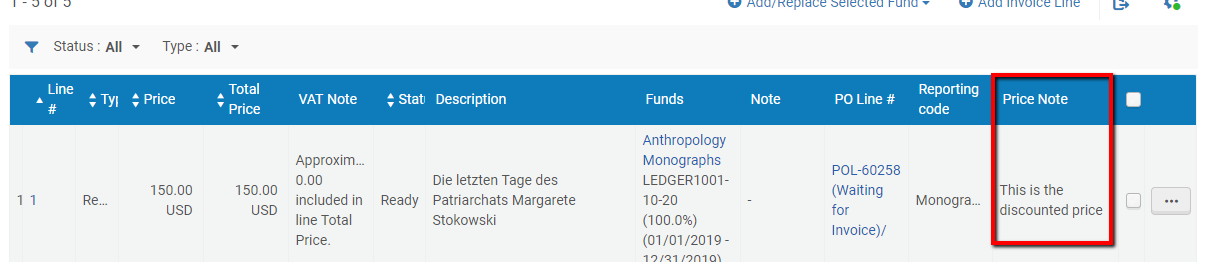

Can a price note be added to the invoice?

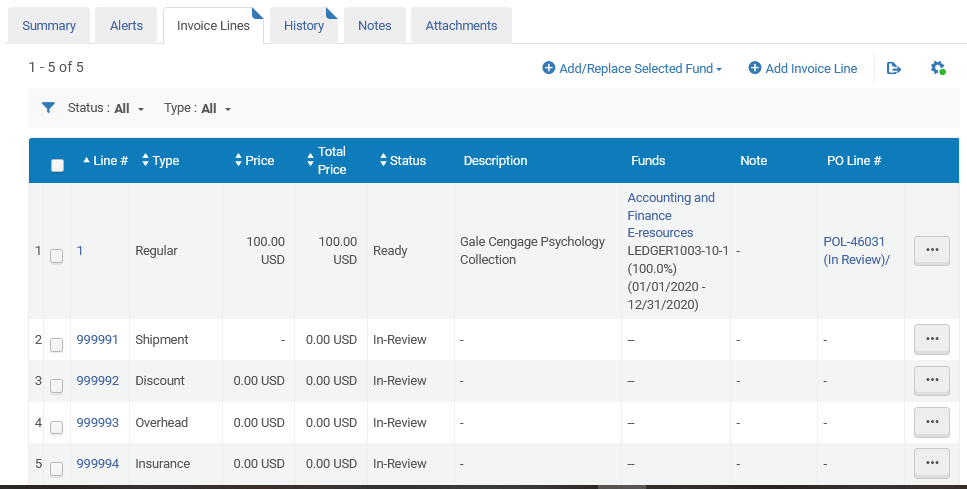

A Price Note, is available on the invoice line. The note appears on the Invoice Line Details page, in the Invoice Line List, and when the invoice lines are exported to a spreadsheet. The column is hidden by default in the Invoice Line List and can be added using the Manage Column Display button. The Price Note may also be imported when loading an invoice from an Excel file or by the RESTful API.

Integration with campus financial systems

How does Alma integrate payment of invoices with the campus financial system?

Alma may integrate with the institution’s financial system for payment for the following functions:

- Export Payment Requests - report to the ERP System on future purchases from the order state

- Import Payment Confirmations

- Export Orders

- Synchronize fund adjustments – this is the “reconciliation” process with the ERP system – load the fund allocations as they were created in ERP System

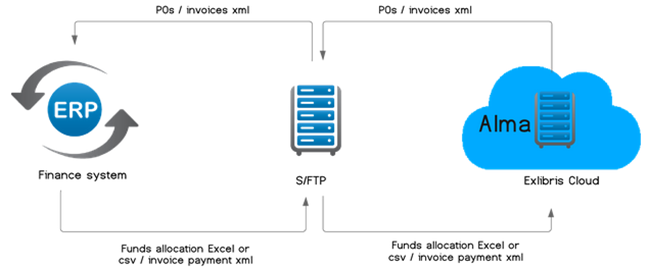

In general, the export and import processes between Alma and the financial system are performed using XML files that are placed at a predefined FTP location. These XML files can be fetched by the financial system (in the case of invoice or PO export) or by Alma (in the case of invoice import). Note that the fund allocation loader process is different because the format is an Excel or CSV file. This is illustrated in the following diagram:

After an invoice has been approved, it reaches the payment stage, in which the invoice awaits payment processing either through Alma or through the institution’s Enterprise Resource Planning system.

Alma’s default configuration assumes that the institution will export invoices to its ERP system. In order to support this workflow, it is necessary to configure a Finance Integration profile, as demonstrated in the screenshot below:

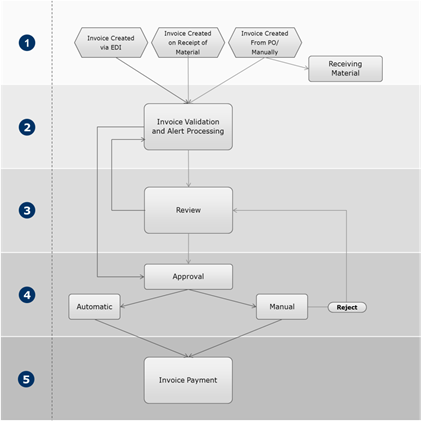

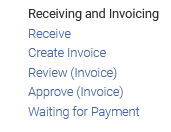

All the invoice stages follow the same workflow:

- In Review – initial step in the workflow

- In Approval – if Approval rules exist in the institution

- Ready to be paid – this is the state where all the invoices wait for the Export job to send them to ERP System

- Sent to ERP (Waiting for payment) – after the invoice is sent to the ERP system it is waiting for payment confirmation

- Closed – Invoice is paid and closed

Invoices may not follow ALL the above stations in the workflow. This is dependent on the invoice itself and the institutional configuration:

- Some institutions do not use ERP integration

- A specific invoice may not be sent to an ERP

- Some institutions may not handle payment in the libraries

Invoices that have been closed or sent to the ERP can be sent back to the Review stage, to enable for editing the invoice after it was rejected by the ERP. Invoices rejected by the ERP are sent to the review stage automatically.

Can payment terms be included in the export of invoices to the institution’s financial system?

Accrual accounting

How does Alma support accrual accounting?

In accrual accounting expenses are recorded at the time in which the transaction occurs rather than when payment is made. This means that if the institution uses accrual accounting it may accumulate expenditures across multiple fiscal years.

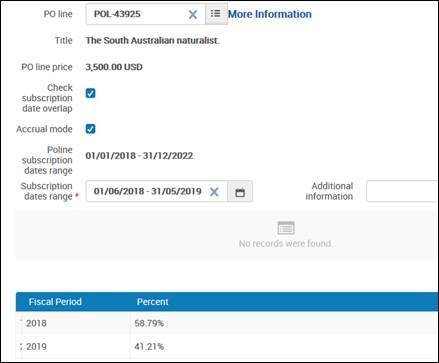

When accrual accounting is enabled in Alma, invoice amounts are spread out over all active fiscal periods, beginning with the fiscal period in which the ‘Subscription from date’ (of the invoice line) is contained. For example, where the institution has two active fiscal periods:

- 2018. The start and end dates for this fiscal year are Jan. 1 2018 – Dec. 31 2018.

- 2019. The start and end dates for this fiscal year are Jan. 1 2019 – Dec. 31 2019.

The library orders a journal and receives an invoice of $3,500 USD (or other unit of currency such as AUD or EUR). The invoice covers the journal subscription for the period from June 1, 2018 – May 31, 2019. The Subscription from date and Subscription to date fields will be entered in the invoice line.

This means that:

- 58.79% of the invoice is for fiscal period 2018 (7/12)

- 41.21% of the invoice is for fiscal period 2019 (5/12)

If Accrual Mode is enabled: The invoice’s charges are distributed proportionally between ‘fiscal period 2018 and fiscal period 2019:

- $2,057.65 of the invoice is for ‘fiscal period 2018’ (58% of the 1000 total)

- $1,442.35 of the invoice is for ‘fiscal period 2019’ (42% of the 1000 total)

VAT, extra charges

How does Alma handle payment of taxes, VAT?

-

Whether the (non governmental) vendor has an associated governmental vendor

-

Whether the vendor is noted as Liable for VAT

-

Whether the VAT is reported for the invoice (either by selecting Report VAT or by manually entering the VAT amount)

|

Governmental Vendor

|

Vendor Liable for VAT |

VAT Reported in Invoice

|

Result

|

|---|---|---|---|

| No | No | No | No special handling |

| No | No | Yes | Before saving the invoice, Alma prompts you to confirm that VAT is included in the invoice amount, even though VAT is not required for the vendor. |

| No | Yes | No | Before saving the invoice, Alma prompts you to confirm that VAT is not included in the invoice amount, even though VAT is required for the vendor. |

| No | Yes | Yes | No special handling |

| Yes | No | No | No special handling |

| Yes | No | Yes | Before saving the invoice, Alma prompts you to confirm that VAT is included in the invoice amount, even though VAT is not required for the vendor. |

| Yes | Yes | No | Before saving the invoice, Alma prompts you to confirm that VAT is not included in the invoice amount, even though VAT is required for the vendor. If you select to report VAT, the configured VAT amount for the governmental vendor is automatically added to the invoice and a separate invoice is generated for this amount to the governmental vendor. If you select to not report VAT, the invoice is saved without VAT. |

| Yes | Yes | Yes | Either the configured VAT for the governmental vendor (if you selected Report Tax), or the amount of VAT that you manually entered, is added to the invoice and a separate invoice is generated for this amount to the governmental vendor. |

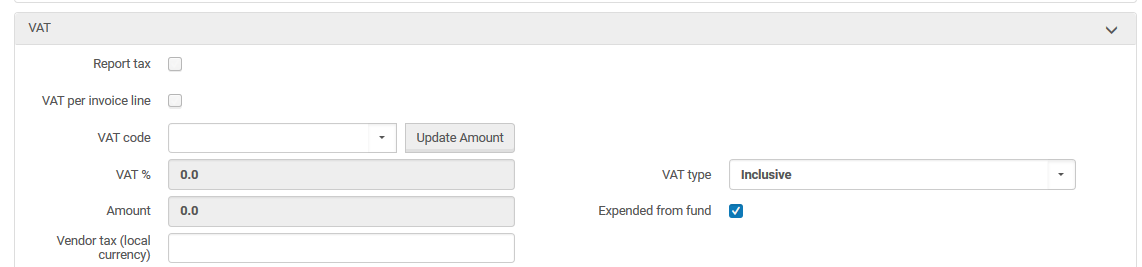

Can VAT be charged at the invoice or line item level?

-

Invoice Line VAT Code

-

The invoice line VAT code.

-

-

Invoice Line VAT Code Description

-

The invoice line VAT code description

-

-

Invoice Line VAT Code %

-

The invoice line VAT code percent

-

-

Invoice Line VAT Note Data

-

The invoice line VAT amount

-

-

Invoice – Expended From Fund

-

Indicates if the VAT is expended from the invoice line?s funds. If it not, a new adjustment invoice line is added to the invoice which includes invoice VAT amounts

-

-

Invoice – Report Tax

-

Indicates if an invoice needs to report state tax.

-

-

Invoice – VAT per invoice line

-

Indicates if the VAT is calculated at the invoice or invoice line level

-

-

Invoice – VAT Amount

-

The total VAT amount

-

-

Invoice – VAT Type

-

Indicates if VAT Exclusive or Inclusive in invoice total amount

-

-

Invoice – VAT Code

-

The invoice VAT code

-

-

Invoice – VAT Code Description

-

The invoice Vat code description

-

-

Invoice – VAT Code %

-

The invoice VAT Code percent

-

-

If you select Use pro rata, the above amounts are not displayed individually on the invoice, and their values are distributed among the invoice lines.

-

If you do not select Use pro rata, each additional charge is displayed as an individual invoice line.

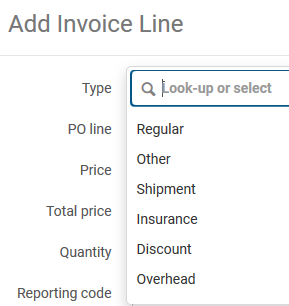

What additional charges can be added to the invoice?

- Shipment amount

- Insurance amount

- Overhead amount

- Discount amount

Total views:

10479