Why do invoices show "Expended from fund = yes" when "VAT expended from fund" is unchecked in the Vendor record?

- Product: Alma, Rialto

Question

Why do invoices show "Expended from fund = yes" when "VAT expended from fund" is unchecked in the Vendor record?

Answer

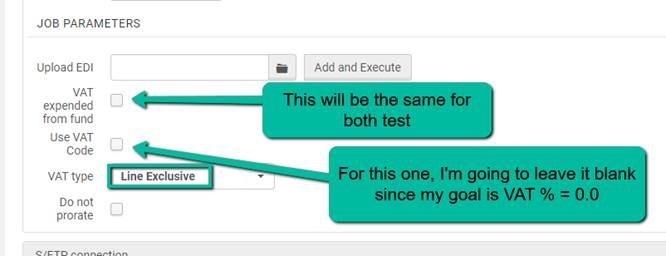

Even if you uncheck "VAT expended from fund" in the Vendor record, the invoice field "Expended from fund" will say "Yes" if the VAT % = 0.0.

Examples

We're going to perform two loads of the same invoice EDI file, one with VAT % = 0.0 and another with VAT % > 0.

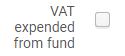

In both cases the EDI tab in the Vendor record has "VAT expended from fund" unchecked.

Test 1 - load invoices with goal VAT% = 0.0

- We set "Use VAT Code" to unchecked.

- Add and execute.

- We get an unexpected outcome - "Expended from fund" = Yes. This is expected.

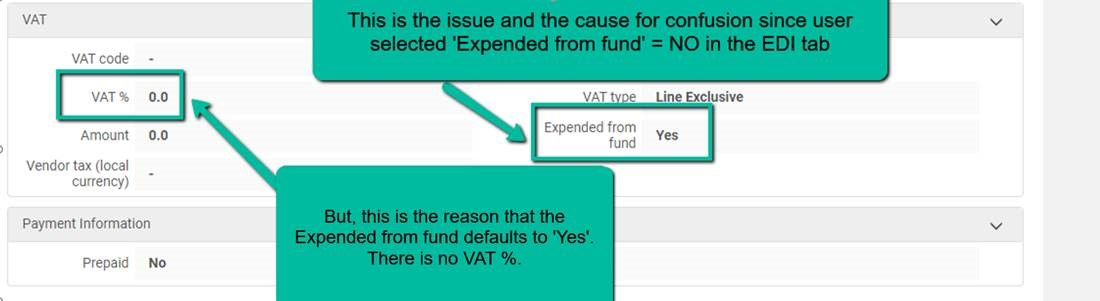

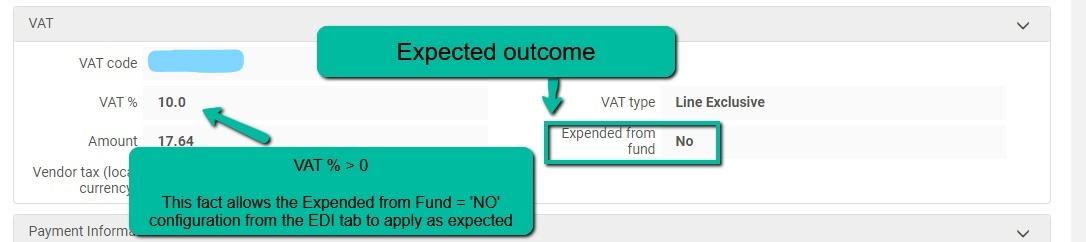

Test 2 - load invoices with goal VAT% > 0.0

- We check "Use VAT Code".

- We're telling Alma to attempt to find the VAT code in the EDI file’s RFF+VA segment and look up the VAT % in my VAT code table (Alma Configuration Menu > Acquisitions > Invoices > VAT Codes)

- This is the code in the EDI file, so now Alma should know that the VAT% in the invoice is supposed to be 10.0%.

- Add and Execute on the same file.

- Outcome:

Additional information:

When the configuration table "Vat Codes" is empty you can add any value to the invoice. When Vat Codes are configured you can select one pf the presented values.

- Article last edited: 13-Oct-2021