Managing Funds and Ledgers

This page describes how to manage funds and ledgers including basic terms, ledger and fund ownership/availability and working with exchange rates. It also includes instructions for adding and deleting funds and ledgers as well as activating/deactivating them. For information on moving funds see Moving Funds and for transferring allocations between funds see Transferring Money Between Allocated Funds. For an overview of working with acquisitions in Alma, including links to relevant sections such as Invoicing, Working with Orders/PO Lines, Renewals, Configuration, etc., see Introduction to Acquisitions.

- Fund Manager

- Fund-Ledger Viewer (view only)

- Ledger Manager

- Fund-Ledger Viewer (view only)

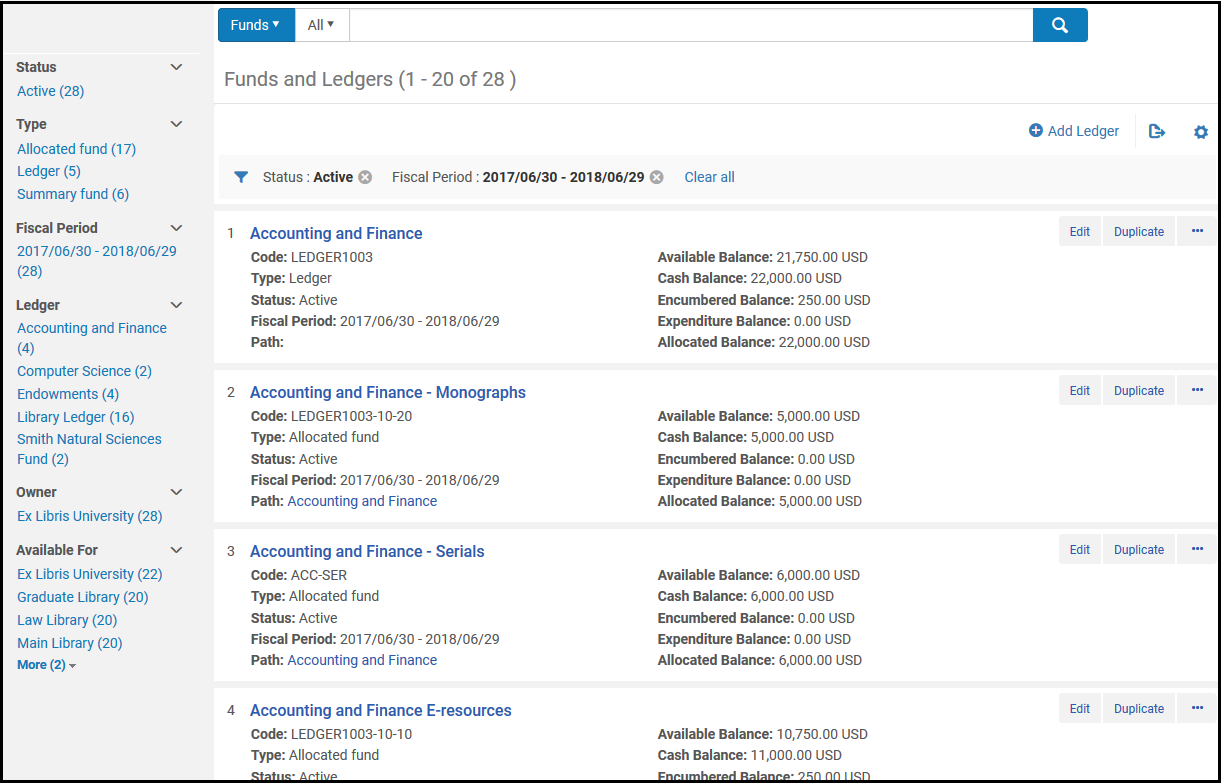

- Name - The fund or ledger name

- Code - The fund or ledger code

- Type - Ledger, Allocated fund, or Summary fund

- Status - Active (operational), Draft (not yet active), and Inactive (no longer active)

- Fiscal Period - The financial year to which the ledger applies. See Configuring Fund and Ledger Fiscal Periods.

- Path - The ledger / summary funds to which this fund belongs. Select an item in the path to view the ledger / summary fund. This field is empty for ledgers.

- Available Balance - See Fund Transaction Terminology

- Cash Balance - See Fund Transaction Terminology

- Encumbered Balance - See Fund Transaction Terminology

- Expenditure Balance - See Fund Transaction Terminology

- Allocated Balance - See Fund Transaction Terminology

- Row actions:

- Edit - See Editing a Ledger and Editing a Fund.

- Duplicate - Add a ledger or fund by duplicating it; see Adding a Ledger and Adding a Fund.

- Deactivate / Activate - See Activating and Deactivating Funds and Ledgers.

- Delete - See Deleting Funds and Ledgers.

- Move Fund (fund only) - See Moving Funds.

Fund Transaction Terminology

- A fund can be allocated or summary.

- A summary fund is not used for ordering and invoicing, but provides aggregate reporting on subordinate funds. You can add other funds to this type of fund.

- An allocated fund contains money that has been paid out or has been reserved for an open purchase.

A Ledger Fund can be associated with a Summary or Allocated Fund.

A Summary Fund can only be associated with an Allocated Fund.

A specific Allocated Fund (i.e. Allocated Fund 101) can only be associated with only one Ledger or Summary Fund, but not both.

- A transaction can be an allocation, encumbrance, disencumbrance, or expenditure:

- An allocation adds money to the fund, increasing its available balance.

- An encumbrance indicates money that is expected to be paid out, as the result of a PO line. This decreases its available balance. The encumbrance is closed if there is an equal disencumbrance linked to the same PO line.

- An expenditure subtracts money from the fund, decreasing its available balance. Adding an expenditure linked to a PO line increases the value of the disencumbrance linked to that PO line.

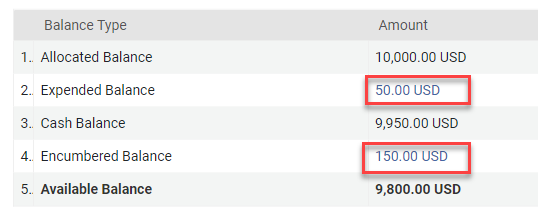

- A disencumbrance is added or increased when adding an expenditure linked to the same PO line as an encumbrance. There is never more than one disencumbrance for any encumbrance. For example:

- If a fund has a $100 encumbrance for a PO line. An invoice for $50 linked to that PO line is received. The encumbrance remains $100, an expenditure of $50 is added, and a disencumbrance of $50 is added.

- After receiving another $50 invoice for the PO line, there are now two expenditures (each for $50), an encumbrance of $100, and a disencumbrance of $100. The encumbrance is now considered fully paid and is closed.

- A fund's available balance is its allocated balance, less (encumbrances minus disencumbrances) and less expenditures.

- A fund's cash balance is its allocated balance less expenditures.

- A fund's allocated balance is its total allocation, not counting any expenditures or encumbrances/disencumbrances.

- A fund's encumbered balance is the sum of its encumbrances minus disencumbrances. This field links to the list of all purchase order lines that have an encumbrance transaction on the fund (even if the purchase order line already has an invoice and is fully dis-encumbered).

- A fund's expenditure balance (Expended Balance) is the sum of its expenditures. This field links to the list of all purchase order lines that have an expenditure transaction on the fund.

Ledger and Fund Ownership and Availability

This applies to both allocated and summary funds.

Exchange Rate Handling in Funds

| Date | Events | Exchange Rate EUR/USD | Encumbrance | Expenditures | Disencumbrance | Available Balance |

|---|---|---|---|---|---|---|

| Thursday | A USD 100 PO Line is sent, to be paid from a EUR fund | 0.91 | Value: 100 USD Calculated: EUR 91 Exchange Rate Date: Thursday Status: Open |

909 EUR:

1000

- 91 encumbrance

|

||

| Friday | 0.92 | Value: 100 USD Calculated: EUR 91 Exchange Rate Date: Thursday Status: Open |

909 EUR:

1000

- 91 encumbrance

|

|||

| Saturday | The recalculation job runs | 0.93 | Value: 100 USD Calculated: EUR 93 Exchange Rate Date: Saturday Status: Open |

907 EUR:

1000

- 93 encumbrance

|

||

| Sunday | An invoice for $50 associated with this PO line arrives | 0.94 | Value: 100 USD Calculated: EUR 93 Exchange Rate Date: Saturday Status: Open |

1: 47 EUR (50 USD based on Sunday's exchange rate date) | Value: 50 USD Calculated: EUR 46.50 (50 USD calculated at 0.93 EUR) Exchange Rate Date: Saturday |

906.50 EUR:

1000

- (93 encumbrance - 46.50 disencumbrance)

- 47 expenditure

|

| Monday | 0.92 | Value: 100 USD Calculated: EUR 93 Exchange Rate Date: Saturday Status: Open |

1: 47 EUR | Value: 50 USD Calculated: EUR 46.50 (50 USD calculated at 0.93 EUR) Exchange Rate Date: Saturday |

906.50 EUR:

1000

- (93 encumbrance - 46.50 disencumbrance)

- 47 expenditure

|

|

| Tuesday | An invoice for $50 associated with this PO line arrives The PO line is fully paid and the encumbrance is closed. |

0.90 | Value: 100 USD Calculated: EUR 93 Exchange Rate Date: Saturday Status: Closed |

1: 47 EUR 2: 45 EUR (50 USD based on Tuesday's exchange rate date) |

Value: 100 USD (50 USD + 50 USD) Calculated: EUR 93 (50 USD calculated at 0.93 EUR + 50 USD calculated at 0.93 EUR) Exchange Rate Date: Saturday |

908 EUR:

1000

- (93 encumbrance - 93 disencumbrance)

- 47 expenditure

- 45 expenditure

|

Explicit Exchange Rates

For institutions that purchase resources with a different currency than the default currency and have agreements on specific exchange rates, you can define a fixed exchange rate in the Explicit Exchange Rates code table (Configuration Menu > Acquisitions > Invoices > Explicit Exchange Rates), for more information see: Configuring Explicit Exchange Rates. The Explicit Exchange Rate configuration has an impact on the encumbrances (PO lines) and expenditures (Invoices) associated with the fund as the exchange rate is applied to the PO line at the time of creation and to the invoice once it is approved.

Adding a Ledger

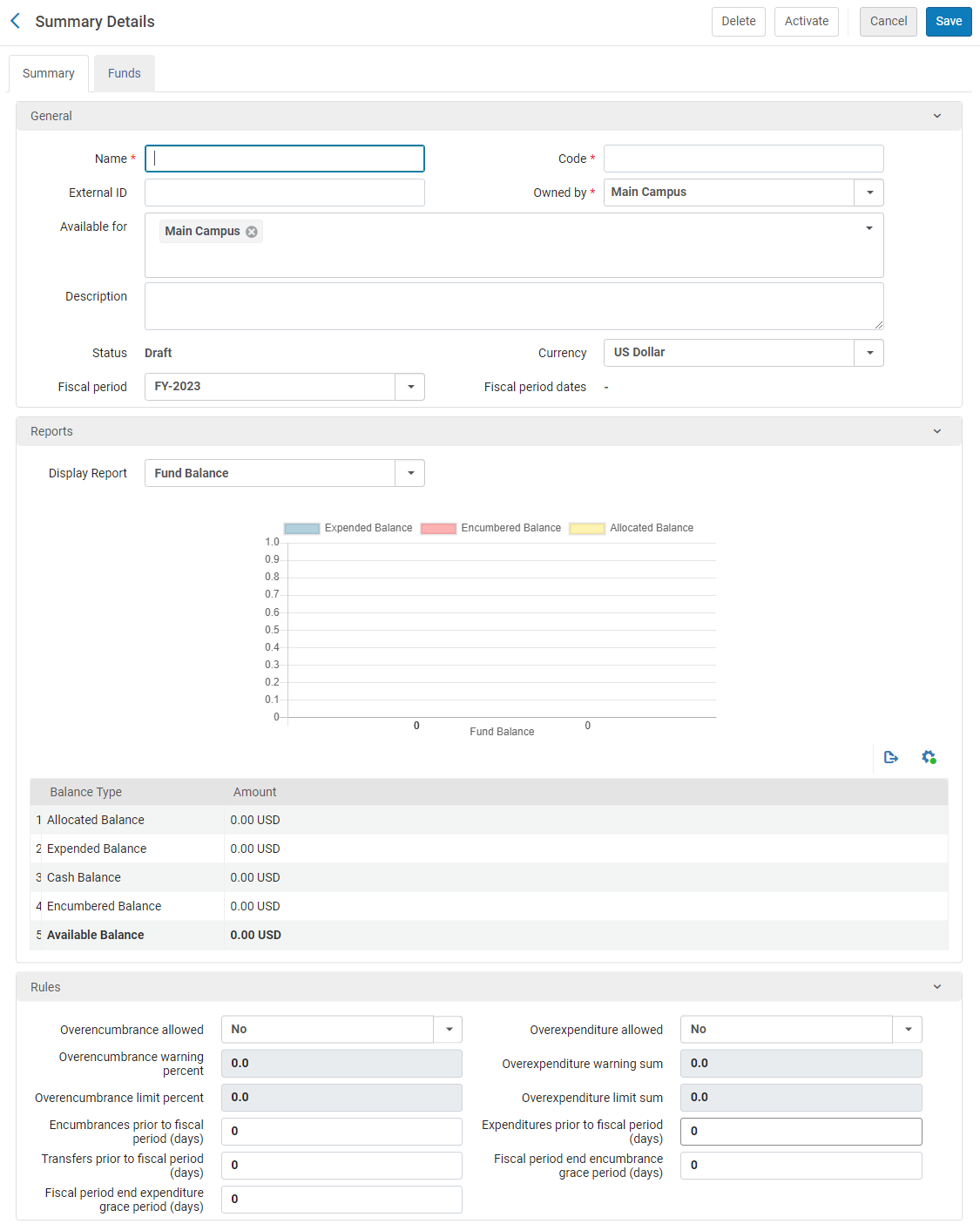

- On the Funds and Ledgers page (Acquisitions > Acquisitions Infrastructure > Funds and Ledgers), select Add Ledger. The Summary Details page appears.

Add Ledger - Summary DetailsTo create a copy of a ledger, select Duplicate in the row actions list for the ledger on the Funds and Ledgers page. After copying the ledger, modify it as required.

Add Ledger - Summary DetailsTo create a copy of a ledger, select Duplicate in the row actions list for the ledger on the Funds and Ledgers page. After copying the ledger, modify it as required. - In the Summary tab, enter the name and code for the ledger (mandatory).

The code is reused when you roll over the ledger to a new fiscal period, so don’t use a year-based code, such as MAIN LEDGER 2015. The name of the ledger can be changed when it is rolled over to a new fiscal year.The field limit is 255 characters (applies to both the code and the name).

- Configure the optional fields for the ledger in the General section.

General Ledger Details Field Description External ID This ID is used to link to other system keys. The field limit is 255 characters. Owned by The owning institution or library. A ledger can only have one owner. By default, this is the institution, which makes the ledger available to all of the libraries in the institution. If the ledger should be available to more than one library in the institution, but not all of them, under Owned by, select the institution, and then, under Available for, select all of libraries that can use it. If you change Owned by to one of the libraries, the ledger will only be available to that library.When changing this at a later time, you can change the ownership from a library to the institution, but you can not change the ownership from a library to another library or from the institution to a library.Available for The libraries that can use funds from this ledger. By default, this matches the selection under Owned by: either the institution or a single library. If it is a single library, this field cannot be modified. If it is the institution, all of the libraries in the institution can use the ledger, but you can modify the field so that only certain libraries can do so.

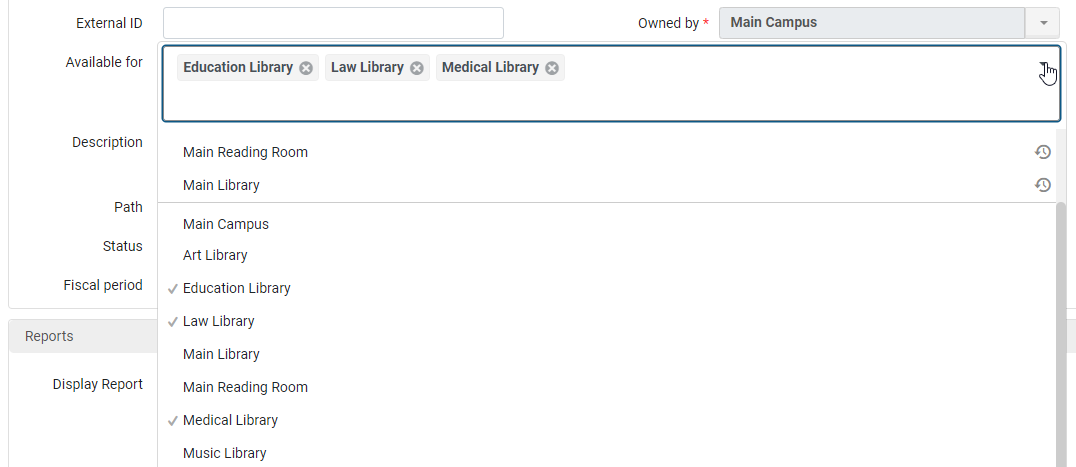

To limit the ledger's use to specific libraries:

- Select the field to open a dropdown list of the institution and all of its libraries.

- Clear the institution checkmark, and select all of the libraries for which the ledger should be made available. The selected libraries are added to the field. For example, in the illustration below, the institution, Main Campus, is the owner of the fund, but it is cleared from the Available for field, while three specific libraries are added to the field; the ledger is thus available only to the three selected libraries.

Be sure to clear the institution selection if you want to limit access to the ledger to specific libraries. If you do not, when you save the ledger, all of the library selections are removed, and only the institution remains.

Description The ledger’s description. Status The ledger’s status: - Active – Operational in the system

- Draft – Configured in the system but not yet operational

- Inactive – Not operational in the system (after previously being active)

Currency The default unit of currency for the ledger. To configure currencies, see Configuring Currencies. Fiscal period The financial year to which the ledger applies. Only Active fiscal periods appear in the list. To configure these options, see Configuring Fund and Ledger Fiscal Periods. Also, for more information on fiscal periods, see Fiscal Period Closure. Fiscal period dates The financial dates to which the ledger applies. For information, see Configuring Fund and Ledger Fiscal Periods. - In the Reports section, select the type of report you want to display from the Display report field:

- Fund Balance – Displays the previously labeled Balance report

- Fund Burn Down – Displays the Fund Burn Down report configured in Alma Analytics

- In the Rules section, configure the fields associated with the policy behavior of encumbrances and expenditures for this ledger.

Ledger Rules Field Description Overencumbrance allowed Whether the fund allows you to add an encumbrance whose amount exceeds the fund's available balance (the allocated balance less any expenditures and encumbrances). The valid values are: - No

- Yes – Alma checks the specified limit in the fund and performs a calculation against the fund’s amount. (If no limit is specified, the limit is assumed to be 0, which means that Yes will function like No.)

- No Limits – indicates that overencumbrances are allowed without limits. Alma does not check the specified limit or whether the fund has money.

Calculating the Overencumbrance Limit:

A + B

- A = Allocated Balance

- B = Overencumbrance Limit Percent

(The amount of the allowed Overencumbrance is calculated by the percentage from the total allowed Balance, so that if the balance is 100 and the limit percent is 50%, then the Overencumbrance Limit is 150.)

The Overencumbrance Limit takes into account and is compared to (PO line Net Price + Encumbrance Balance) when checking if the fund can be used for a specific PO Line. This depends on its Net Price and the Encumbered Balance.

The Overencumbrance Limit cannot be less than the combined amount of the PO line Net Price + Encumbrance Balance.

Overexpenditure allowed Whether the fund allows you to add an expenditure whose amount exceeds the fund's available balance. The valid values are: - No

- Yes

- No Limits – indicates that overexpenditures are allowed without limits.

Overencumbrance warning percent The percentage of allowed overencumbrances permitted before the system provides a warning. When that amount is reached, an alert is displayed that the overencumbrance warning threshold has been reached. If the user confirms that the transaction should be added, an alert is added for the entity that created the fund transaction. Overexpenditure warning sum The amount of overexpenditure before the system provides a warning. Overencumbrance limit percent The maximum percentage of allowed encumbrances permitted before the system blocks the creation of an encumbrance. When that amount is reached, the transaction creation is blocked. Overexpenditure limit sum The amount of overexpenditure (checked against the allocated balance) before the system blocks the creation of an overexpenditure.

Alma performs the check by adding the amount of overexpenditure to the allocated balance, and then subtracting encumbrances and expenditures from that sum.Encumbrances prior to fiscal period (days) The number of days, prior to the fiscal period start date, that new encumbrances can be created. If negative, you cannot create encumbrances during the specified number of days after the fiscal period start date.When working with accrual accounting, it is recommended to set this to 365 (or as early as required to enter the accrual invoices). See Working with Accrual Accounting.When creating PO lines in a non-manual way (API, EOD etc.):

If a fund for the current period is active at the same time as a fund from the next fiscal period, the one from the next fiscal period is used if this value permits it. If you do not want encumbrances added to the fund from the next fiscal period while the fund from the current fiscal period is still active, set this to 0.

When creating PO lines manually:

When creating a PO line, the user chooses the fund. If there are two funds available, one for the current fiscal period and another for the next fiscal period, the user chooses which fund to use. In this case the encumbrance/expenditure will be implemented on the selected fund.Expenditures prior to fiscal period (days) The number of days, prior to the fiscal period start date, that new expenditures can be created. If negative, you cannot create expenditures during the specified number of days after the fiscal period start date.When working with accrual accounting, it is recommended to set this to 365 (or as early as required to enter the accrual invoices). See Working with Accrual Accounting.Transfers prior to fiscal period (days) The number of days, prior to the fiscal period start date, that new money transfers can be created. If negative, money transfers are blocked during the specified number of days after the fiscal period start date.When working with accrual accounting, it is recommended to set this to 365 (or as early as required to enter the accrual invoices). See Working with Accrual Accounting.You can only transfer money between funds of the same fiscal period. For more information, see Managing Fund Allocation Transfer.Fiscal period end encumbrance grace period (days) The number of days, after the fiscal period end date, that new encumbrances can be created. If negative, the system blocks new encumbrances during the specified number of days prior to the end of the fiscal period.Fiscal period end expenditure grace period (days) The number of days, after the fiscal period end date, that new expenditures can be created. If negative, the system blocks new expenditures during the specified number of days prior to the end of the fiscal period. - In the Funds tab, select Add Fund to add a fund to the ledger. For information, see Adding a Fund. This option is available only if you selected Edit to edit an existing ledger.

- Select Save to store the ledger information that you entered and return to the Funds and Ledgers page.

Exchange rate updates can cause Alma to recalculate encumbrances and expenditures.

Editing a Ledger

- On the Funds and Ledgers page (Acquisitions > Acquisitions Infrastructure > Funds and Ledgers), select Edit in the row actions list for the ledger whose information you want to update. The Summary Details Page appears. See Adding a Ledger.

- On the Summary Details page, edit the ledger information as required (note that the Code, Currency, and Fiscal Period fields are not editable). For information on this page, see Adding a Ledger.

Changing the ownership of the ledger changes the availability scope of the ledger and the ownership of all of its funds, but does not change the availability scope of the funds. When you remove the availability of a ledge from one or more libraries, the associated funds are also made unavailable to these libraries. When you add availability to a ledger for one or more libraries, the funds remain unavailable to the libraries unless you add them as well.

- In the Funds tab, add, edit, duplicate, deactivate, or move funds as required. For information on adding funds, see Adding a Fund.

- In the Notes tab, add, update, or delete notes for the ledger. See Notes Tab.

- In the Attachments tab, add, update, or delete attachments for the ledger. See Attachments Tab

- To store your changes and deactivate the ledger, select Deactivate. To activate the ledger select Activate. Otherwise, to store your changes, select Save.

Adding a Fund

Rules are inherited automatically from the ledger. All changes applied to the rules of the ledger can be automatically seen in the funds associated with them (for example, the grace period). The inheritance works, if there is nothing configured in the Fund tab.

Thus, if you configure extra fund rules, which causes the Ledger Rules to be overridden and the inheritance to be annulled, the tab Restore Rules Information will appear. You need to select Restore Rules Information, and then restore each one individually. You can either set specific rules for each fund, or each of them will inherit all the rules from the General Ledger.

In the Fund tab, in the Rules section, if there is a tab Restore Rules Information, it indicates that the rules have been customized for the fund. If you select Restore Rules Information, the values will be inherited from the upper level of the hierarchy.

Once the rules are restored, the tab Override Rules Information will appear, which enables you to define your own rules for the fund.

Consequently, if the following tabs appear, it indicates the following:

-

Override Rules Information - that the current values are inherited and have not yet been customized.

-

Restore Rules Information - that the current values have been customized.

You can add a fund to a ledger or to a summary fund. You can add encumbrances to the fiscal period of a fund or ledger only if:

-

The fiscal period is Active

-

The date range of the fiscal period includes the current date

- On the Funds and Ledgers page (Acquisitions > Acquisitions Infrastructure > Funds and Ledgers), select Edit in the row actions list for the ledger or summary fund to which you want to add a fund.

- Select the Funds tab. The Funds List page appears.

- Select Add Fund and select either Allocated fund or Summary fund. The Summary Details page appears.

Add Fund - Summary DetailsIf you want to create a copy of a fund, select Duplicate in the row actions list for the fund you want to copy. Once you have copied the fund, you can modify it as needed.

Add Fund - Summary DetailsIf you want to create a copy of a fund, select Duplicate in the row actions list for the fund you want to copy. Once you have copied the fund, you can modify it as needed. - Enter the fund name and code (mandatory).

The code is reused when you roll over the ledger to a new fiscal period, so don’t use a year-based code, such as MAIN FUND 2015. The name of the fund can be changed when it is rolled over to a new fiscal year. If you are working with accrual accounting (see Working With Accrual Accounting), do not change the name of the fund in the new fiscal period.The field limit is 255 characters (applies to the code and the name). It is recommended that the code not contain any special characters.

- Optionally, enter an external ID for the fund that can be used to link to other system keys, and a description of the fund.

Owned by, Path, Currency, Fiscal period, and Fiscal period dates are inherited from the ledger and cannot be modified. Available for is also inherited, but you can remove libraries to make it more restrictive in the next step.

- If the fund's parent ledger / summary fund was available to more than one library, select the libraries to which this fund is available in Available For. You can make the the fund's availability more restrictive than its parent.

- Optionally enter a fund type. To configure fund types, see Configuring Fund Types.

To make this fund available for attaching to resource sharing requests, the fund type must be Resource Sharing. See Borrowing Requests Associated with Funds.

- To override the rules set by the ledger, in the Rules area select Override Rules Information and then configure the fields associated with the policy behavior of encumbrances and expenditures for this fund. For an explanation of these fields, see Adding a Ledger.

- For a summary fund:

- In the Reports section, select the type of report you want to display from the Display report field, as follows:

- Fund Balance – Displays the previously labeled Balance report.

- Fund Burn Down – Displays the Fund Burn Down report configured in Alma Analytics.

- in the Funds tab, select Add Fund to add a fund to the ledger (starting with step 1 of this process).

- In the Reports section, select the type of report you want to display from the Display report field, as follows:

- Select Save to store the fund information.

Editing a Fund

- On the Funds and Ledgers page (Acquisitions > Acquisitions Infrastructure > Funds and Ledgers), select Edit in the row actions list for the fund whose information you want to update.

- On the Summary Details page, edit the fund information, as required. For more information on this page, see Adding a Fund. Note that the fund’s code is not editable.

- For allocated funds, select the Transactions tab to perform transactions on the fund. For more information on transferring and allocating funds, see Performing Fund Transactions.

- In the Notes tab, add, update, or delete notes for the fund. See Notes Tab.

- In the Attachments tab, add, update, or delete attachments for the fund. See Attachments Tab.

- To store your changes and deactivate the fund, select Deactivate. To activate the fund, select Activate. Otherwise, to store your changes, select Save.

For funds with 10 or more PO lines, when updating the fund name/code, the related PO lines are re-indexed. This is done by a background job that appears in the Monitor Jobs page. The user that made the updates which triggered this re-indexing appears as the operator.

Activating and Deactivating Funds and Ledgers

- You can also activate a fund while adding or editing it by selecting the Activate link on the Funds List page, or by selecting Activate in any of the fund’s tabs, after you have configured the fund. You can also activate a ledger while editing it by selecting Activate in any of the ledger’s tabs.

- You can also deactivate a fund by selecting the Deactivate link on the Funds List page, or by selecting Deactivate in any of the fund’s tabs. You can also deactivate a ledger while editing it by selecting Deactivate in any of the ledger‘s tabs.

- When deactivating a ledger or summary fund, you are prompted to deactivate the funds associated with the ledger or summary fund. All funds associated with a ledger or summary fund must be deactivated before the ledger or summary fund can be deactivated.

Deleting Funds and Ledgers

If the fund (or funds associated with the ledger) have associated transactions, then the fund needs to be activated to show the Transactions tab so that the transactions can be deleted. After all transactions are deleted make the fund inactive to delete it.

Performing Fund Transactions

- View details for a transaction

- Allocate money to an allocated fund

- Transfer money from one allocated fund to another. You can also transfer funds

- To reduce a fund’s allocation, you allocate money using a negative number.

- Any change of PO line fields related to an existing transaction (for example PO line price, Reporting codes etc.) will re-create the transaction and the recreated transaction will display in the Transactions tab. The user who performed the field change displays as the Creator in the transaction.

- Searches in the transactions tab of the Funds are case sensitive.

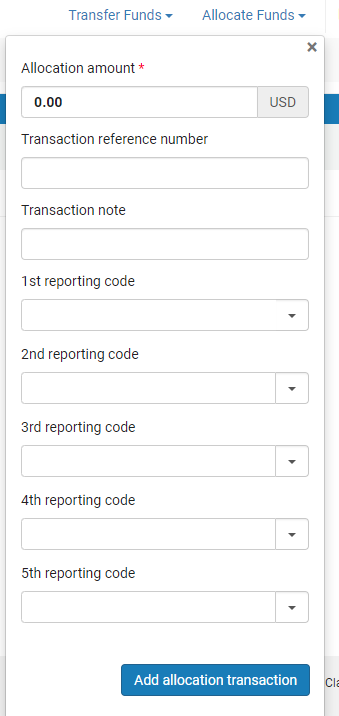

- In the Transactions tab, select Allocate Funds.

Allocation Transaction Page

Allocation Transaction Page - Enter the allocation amount and fill in the following optional fields:

- Transaction reference number – A number that may be used to reference a particular allocation to the fund

- Transaction note – A description of the transaction

- Reporting codes(s) - A code that can be used for analyzing acquisitions in subsequent reporting. For more information, see Configuring Reporting Codes.

- Select Add Allocation Transaction and select Confirm in the confirmation dialog box.

- Select Save.

- In the Transactions tab, select Transfer Funds.

The From fund field contains the value of the current fund, which cannot be changed.

- Continue as described in Transferring Money Between Allocated Funds, starting from step 2.